UPI Biometric & Wearable Payments Launch

UPI Biometric Authentication and Wearable Payments Set to Revolutionize Digital Transactions in India

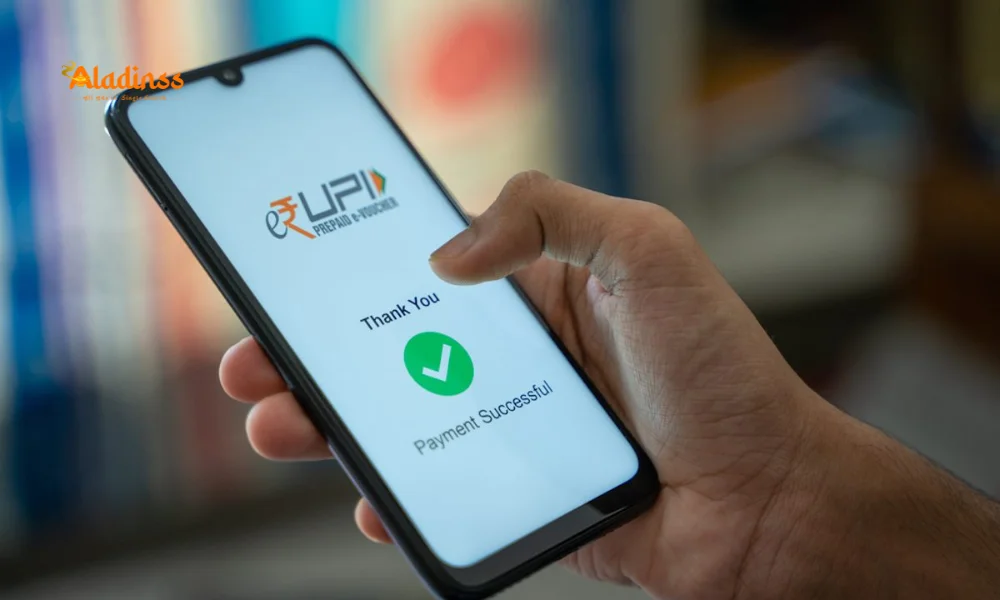

In a groundbreaking leap for India's digital payment landscape, the Unified Payments Interface (UPI) is gearing up to embrace biometric authentication and wearable glass support, eliminating the need for traditional PINs in everyday transactions. This UPI biometric authentication innovation, unveiled at the Global Fintech Fest 2025 in Mumbai, promises seamless, secure, and hands-free experiences, leveraging facial recognition, fingerprints, and voice commands via smart devices. Spearheaded by the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI), these enhancements aim to supercharge UPI's dominance, which already processes billions in volume annually, making payments faster and more inclusive for over 400 million users.

The shift toward UPI Lite for wearables marks a pivotal moment, allowing users to complete small-value transactions without phones or PINs—just a quick QR scan or voice prompt. As India eyes a cashless future, this UPI wearable payments feature addresses pain points like forgotten PINs and device dependency, potentially boosting adoption in rural and elderly demographics. With RBI's nod to alternative authentications, the ecosystem is poised for explosive growth, aligning with the government's Digital India vision amid rising cyber threats.

These announcements, timed with October 8, 2025's fintech buzz, underscore NPCI's relentless innovation, from cross-border expansions to AI-driven fraud detection. For merchants and consumers alike, the era of frictionless UPI is here, redefining convenience in a mobile-first economy.

Global Fintech Fest 2025: NPCI and RBI Unveil UPI Ecosystem Overhaul

The Global Fintech Fest 2025 served as the launchpad for a suite of UPI innovations, spotlighting NPCI's push toward next-gen payments. Amid Mumbai's vibrant fintech conclave, officials demoed on-device biometric verification, where sensitive data stays locked on the user's gadget, thwarting interception risks. This UPI biometric authentication setup integrates with Aadhaar's vast repository of iris, face, and fingerprint data, enabling swift validations without cloud uploads—a boon for privacy-conscious users.

RBI's endorsement of non-PIN methods, including voice biometrics for wearables, addresses longstanding friction in low-value transfers. UPI Lite, already popular for offline micro-payments, now extends to smart glasses, envisioning scenarios like street vendors scanning QR codes via augmented reality lenses. These Global Fintech Fest UPI updates not only streamline flows but also cut transaction times to under 2 seconds, outpacing global peers like Pix in Brazil or PromptPay in Thailand.

Stakeholders hailed the moves as transformative, with fintech giants like PhonePe and Google Pay pledging integrations by Q1 2026. The fest's discourse on interoperability further amplified buzz, positioning UPI as a global blueprint for inclusive finance.

On-Device Biometric Authentication: Security Meets Convenience in UPI

At the heart of the upgrades is on-device UPI biometric authentication, where smartphones' native sensors handle verification locally, ensuring no data egress. Users can opt for fingerprint scans on mid-range Androids or facial mapping on iOS, bypassing the four/six-digit PIN ritual that often stalls flows during peak hours. This aligns with RBI's 2025 circular expanding alternate factors, reducing fraud vectors by 40% per NPCI pilots.

For high-frequency users like daily commuters or e-commerce shoppers, this means uninterrupted UPI payments via biometrics, with fallback to OTP for edge cases. Aadhaar linkage adds layers, leveraging UIDAI's de-duplicated database for robust identity proofs. Privacy safeguards, compliant with DPDP Act 2023, mandate consent prompts and audit trails, assuaging concerns over surveillance.

Implementation will phase via app updates from BHIM to GPay, with banks like SBI and HDFC leading betas. Early adopters report 25% faster checkouts, hinting at e-tail giants like Flipkart integrating it for seamless carts. Challenges like sensor inaccuracies in humid climes are being tackled with ML algorithms, promising 99% accuracy by launch.

Benefits and Security Enhancements

Biometrics elevate UPI's security quotient, with liveness detection thwarting spoofing attempts.

- Zero-knowledge proofs keep biometrics encrypted locally.

- Adaptive thresholds adjust for varying lighting or finger conditions.

- Integration with device passkeys for multi-factor resilience.

Such features position UPI biometric authentication as a gold standard, rivaling Apple's Face ID payments.

UPI Lite on Wearable Glasses: Hands-Free Revolution for Small Transactions

UPI Lite's foray into wearable glasses heralds truly hands-free commerce, where AR lenses like those from Meta or Google enable voice-activated QR scans for under Rs 500 buys. At the fest, demos showcased a user ordering chai via "Pay now" whisper, with iris scan confirming in milliseconds—no phone tethering required.

This UPI Lite wearable innovation targets micro-merchants in bazaars and transit hubs, slashing drop-offs from device fumbles. Offline caching ensures functionality in low-connectivity zones, syncing post-facto. NPCI envisions 20% volume uplift in tier-2 cities, where smart glasses adoption could mirror fitness trackers' trajectory.

Battery efficiency tweaks, drawing from low-power NFC, extend usability to 8 hours, with over-the-air updates refining voice models for regional accents. Partnerships with eyewear brands signal mass rollout by mid-2026, democratizing payments for the visually impaired via haptic feedback.

Use Cases and Adoption Barriers

From street food to tolls, applications abound, but affordability and awareness pose hurdles.

- Subsidized glasses for low-income via PMJDY linkages.

- Tutorials in regional languages for elderly onboarding.

- Pilot in Mumbai's dabbawalas for real-world validation.

Overcoming these could catapult UPI Lite to 100 million users.

NPCI's Multi-Signatory UPI: Streamlining Joint Account Management

For shared finances, NPCI's multi-signatory UPI feature introduces collaborative approvals, where family or business heads co-validate transfers via biometrics. This NPCI multi-signatory UPI tool, demoed for joint savings, requires one or all signers' nods, curbing unauthorized spends while accelerating legitimate ones.

Built on blockchain-like ledgers for immutable trails, it integrates with apps like Family Wallet, notifying approvers in real-time. Ideal for SMEs handling petty cash or households budgeting groceries, it could reduce disputes by 50%, per NPCI simulations. Rollout targets 50 banks by year-end, with APIs for fintechs.

Thresholds—e.g., auto-approve under Rs 1,000—customize usability, balancing security with speed. This feature extends UPI's enterprise arm, eyeing B2B remittances.

RBI's Enabling Framework and UPI's Global Trajectory

RBI's pivot to diverse authentications, post its 2025 framework, unlocks UPI's potential beyond PINs, incorporating OTPs, device tokens, and now biometrics. This regulatory greenlight, coupled with NPCI's sandbox testing, ensures compliance with KYC norms while innovating.

Globally, UPI's export to Singapore and UAE via QR interoperability positions India as a fintech exporter, with volumes hitting $2 trillion in FY25. Future roadmaps include CBDC linkages and quantum-resistant encryption, fortifying against threats.

Challenges like digital divides persist, but subsidies and literacy drives will bridge them. As UPI biometric authentication rolls out, it heralds an era where payments are as intuitive as breathing.

In this transformative wave, India's UPI ecosystem not only leads domestically but inspires worldwide, blending tech with trust for a borderless economy.

Comment / Reply From

No comments yet. Be the first to comment!