Worlds 10 Richest Places Where Global Wealth Lives

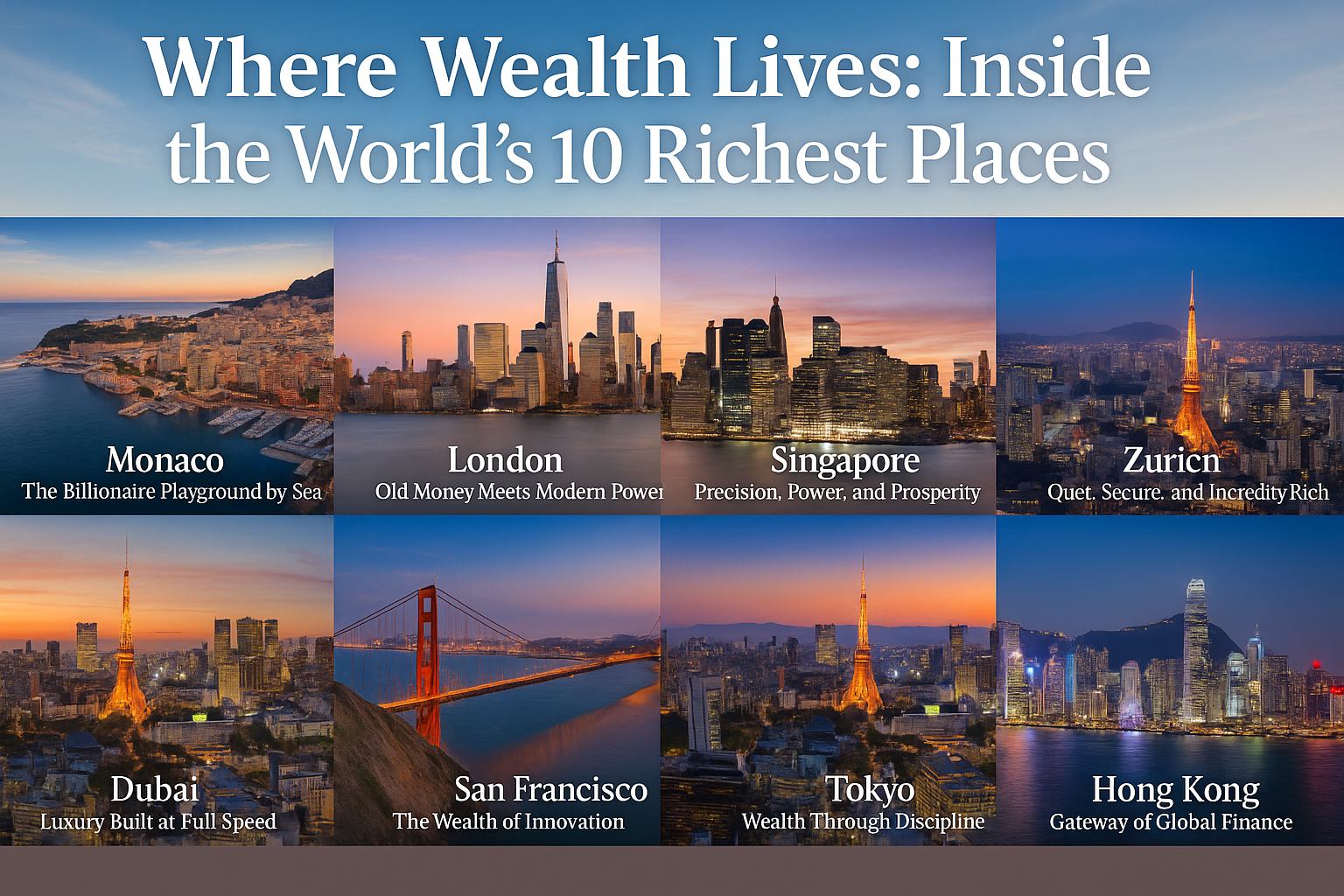

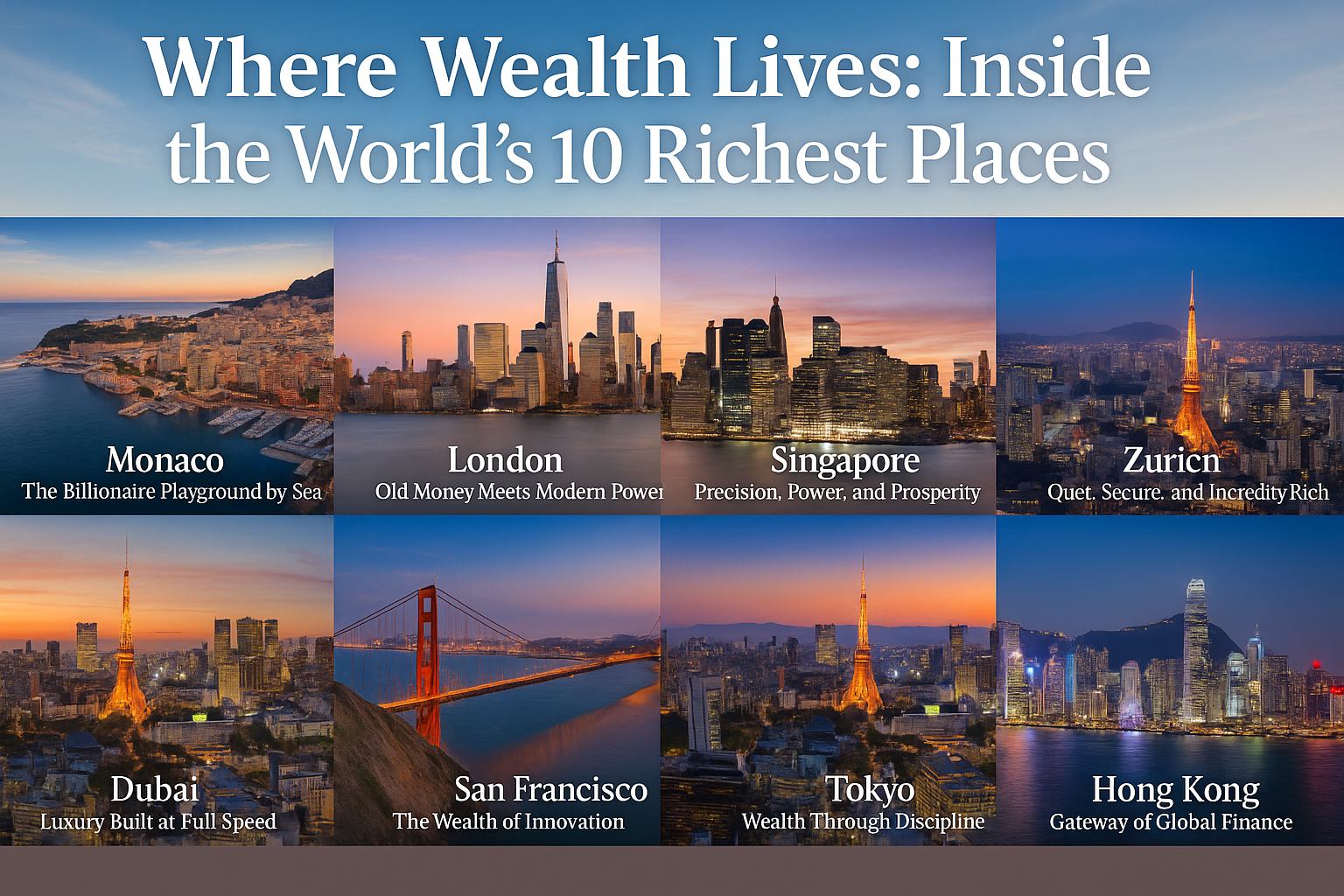

Where Wealth Lives: Inside the World's 10 Richest Places

Wealth does not exist in isolation. It settles into cities, reshapes skylines, influences culture, and quietly defines how life is lived. Across the globe, there are places where money isn't just earned -it stays, grows, and becomes part of the environment. These locations attract billionaires, global investors, royalty, and legacy families, not only because of financial opportunity, but because of lifestyle, safety, influence, and long-term security. Below are ten places where wealth feels permanent.

According to multiple global wealth reports and financial market updates, these cities continue to dominate discussions around high-net-worth concentration, premium real estate demand, and long-term capital preservation. The latest developments show that despite economic fluctuations, wealth continues to consolidate in stable, globally connected urban centers.

1. Monaco -The Billionaire Playground by the Sea

Monaco stands as the most concentrated symbol of wealth on Earth. This tiny principality on the French Riviera has perfected the balance between glamour and control. Nearly one in three residents here is a millionaire, a statistic that feels believable the moment you arrive. Space is limited, privacy is priceless, and every square meter of land carries extraordinary value. With no personal income tax, strong governance, and unmatched security, Monaco attracts those who prefer stability over spectacle, even while living surrounded by luxury.

Life in Monaco moves at a refined pace. Superyachts line the harbor like art installations, and world-class events blend seamlessly into daily routines. Yet the city is not chaotic or loud -it is measured, clean, and carefully managed. Wealth here does not chase attention; it already has it. Monaco's true richness lies in how quietly powerful it feels, offering residents a life where everything works exactly as it should.

2. New York City -Capital of Global Money

New York is not elegant in the traditional sense, but it is unmatched in influence. This city doesn't just hold wealth -it creates it, multiplies it, and exports it across the world. Wall Street, private equity firms, hedge funds, real estate empires, media powerhouses, and tech investors all coexist in a dense, relentless ecosystem. Money moves fast here, and those who survive learn to move faster.

Despite its intensity, New York offers something rare: opportunity without permission. Billionaires live next door to dreamers, and success stories are written every day. From Manhattan penthouses to discreet townhouses in Brooklyn, wealth here adapts to personality. New York remains one of the richest places in the world not because it is comfortable, but because it rewards ambition like nowhere else.

3. London -Old Money Meets Modern Power

London carries wealth differently. It is layered, historical, and deeply embedded in tradition. Centuries-old institutions coexist with modern finance, making the city a global center for banking, law, real estate, and diplomacy. Wealth here often moves through generations, protected by legacy, education, and influence rather than speed.

What makes London unique is its ability to attract global money without losing its identity. From Mayfair to Kensington, property is treated as a store of value rather than a trend. London feels secure, respected, and timeless -qualities that keep wealth anchored even during global uncertainty.

4. Singapore -Precision, Power, and Prosperity

Singapore is a modern financial masterpiece. Built on discipline, transparency, and efficiency, the city-state has become Asia's most trusted home for wealth. Strong governance, low corruption, and business-friendly policies have turned Singapore into a magnet for multinational companies and ultra-high-net-worth individuals.

Life in Singapore feels controlled but rewarding. Infrastructure is flawless, public spaces are pristine, and everything functions with purpose. Wealth here is not flashy -it is strategic. Singapore proves that money flows best where systems are respected and futures feel secure.

5. Dubai -Luxury Built at Full Speed

Dubai is the boldest expression of modern wealth. In just a few decades, it transformed from desert land into a global symbol of ambition. Skyscrapers rise where sand once ruled, and luxury is integrated into everyday life. Zero income tax, global connectivity, and investor-friendly policies have made Dubai irresistible to entrepreneurs and global elites.

What sets Dubai apart is its confidence. It does not hide its wealth; it celebrates it. Yet beneath the glamour lies smart planning, rapid execution, and a vision built around growth. Dubai is rich not just in money, but in belief -belief that anything can be built fast if ambition is high enough.

6. San Francisco Bay Area -The Wealth of Innovation

The Bay Area represents a different kind of richness. Here, wealth is born from ideas. Technology companies, venture capital firms, and startups have created fortunes at unprecedented speed. Innovation is the currency, and disruption is respected.

Despite rising costs and visible contrasts, the region remains a powerhouse. Wealth here is often understated -hoodies instead of suits, simple offices behind billion-dollar ideas. The Bay Area proves that intellectual capital can be just as powerful as inherited wealth.

7. Zurich -Quiet, Secure, and Incredibly Rich

Zurich continues to rank among the world's most resilient wealth centers, according to the latest global financial stability reports. The city benefits from Switzerland's long-standing reputation for neutrality, strong currency performance, and strict regulatory frameworks that protect private capital. Zurich's financial institutions play a crucial role in managing cross-border assets, making it a preferred destination for international investors seeking long-term wealth preservation rather than short-term gains.

Recent developments show increased demand for Zurich's premium residential zones, driven by global uncertainty and shifting investment strategies. Wealth in Zurich is deeply linked to discretion and trust, where privacy laws and financial discipline remain core strengths. This steady environment has allowed the city to maintain its status as one of the safest and most reliable locations for global wealth in an evolving economic landscape.

8. Tokyo -Wealth Through Discipline

Tokyo's position among the richest places in the world is supported by its massive economic scale and corporate dominance. Home to some of the world's most valuable multinational companies, the city benefits from strong manufacturing, advanced technology, and resilient domestic markets. Financial analysts note that Tokyo's wealth ecosystem is built on consistency, careful planning, and long-term institutional growth rather than sudden expansion.

In recent years, Tokyo has also seen renewed interest from global investors due to stable governance and expanding digital innovation. Despite high population density, the city manages wealth with efficiency and precision, ensuring reliable infrastructure and disciplined financial systems. Tokyo's economic strength lies in its ability to sustain prosperity through order, patience, and structured development.

9. Paris -Culture, Capital, and Influence

Paris remains a major global wealth center due to its influence across luxury, finance, and cultural capital. The city hosts headquarters of some of the world's most powerful fashion, beauty, and luxury conglomerates, contributing significantly to France's economic strength. Parisian wealth is closely tied to heritage industries that continue to dominate international markets, from haute couture to fine art and real estate.

Recent market updates indicate steady investment in Paris's high-end property sector, particularly in historic districts that retain long-term value. The city's global appeal, combined with strong institutional backing, allows Paris to attract elite investors who value prestige and cultural influence alongside financial returns. Paris stands out as a city where wealth is reinforced by identity and global recognition.

10. Hong Kong -Gateway of Global Finance

Hong Kong's wealth status is driven by its role as a gateway between Eastern and Western markets. The city continues to serve as a critical hub for capital flows, international banking, and stock market activity. Financial reports highlight Hong Kong's deep liquidity, advanced financial infrastructure, and strategic location as key reasons for its sustained wealth concentration.

Despite economic and geopolitical changes, Hong Kong remains a preferred base for multinational firms and high-net-worth individuals operating across Asia. Property markets, financial services, and global trade continue to anchor wealth within the city. Hong Kong's strength lies in its speed, connectivity, and ability to adapt, ensuring that money continues to move efficiently through its financial systems.

Comment / Reply From

No comments yet. Be the first to comment!