Gold Prices Fall Today: Latest 22K and 24K Rates Across India

Gold Prices Dip Today: Check 22K, 24K Rates Across India

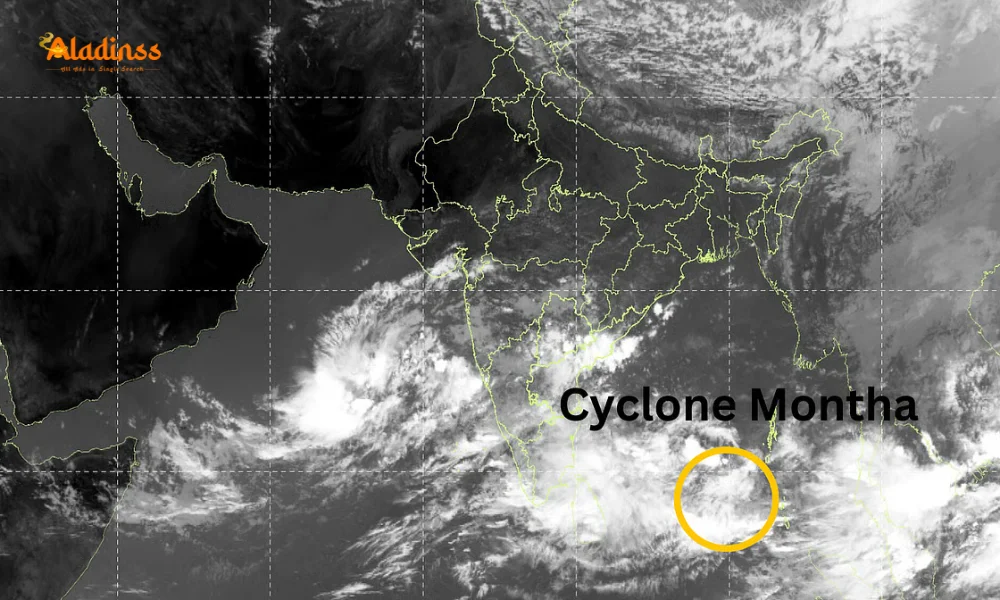

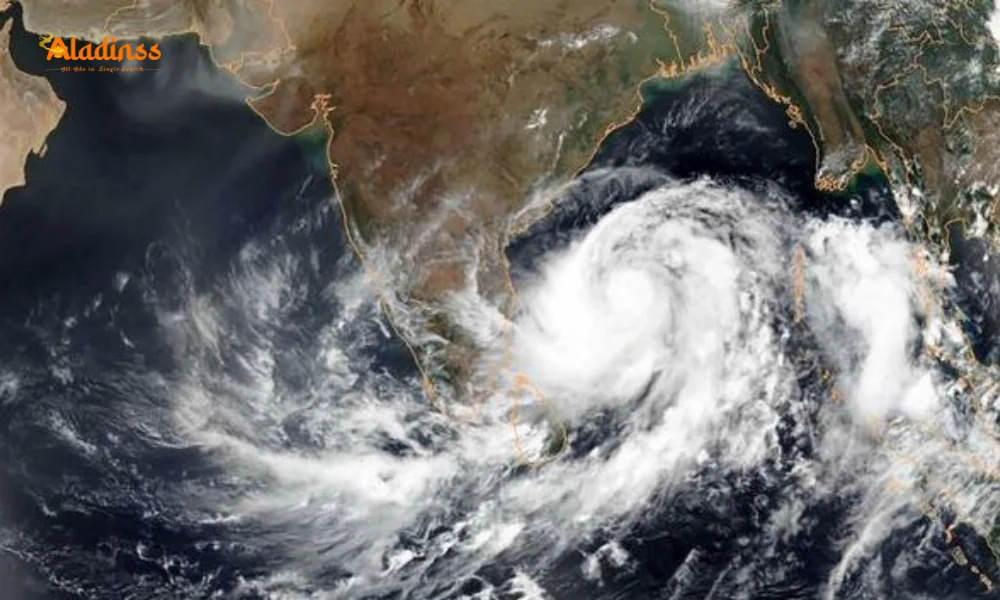

Gold prices in India witnessed a slight decline on October 24, 2025, following a post-Diwali correction phase after a record-breaking rally. In Mumbai, 24-carat gold is priced at Rs 1,25,070 per 10 grams, while 22-carat gold stands at Rs 1,14,640 per 10 grams. Silver prices also saw a marginal drop, trading at Rs 1,58,900 per kg. This shift comes as investors and buyers closely monitor market trends, especially with the northeast monsoon impacting parts of India, influencing economic sentiments.

On the Multi Commodity Exchange (MCX), gold futures for December 05, 2025, fell by 0.34%, trading at Rs 1,23,683 per 10 grams as of 9:23 AM IST. Similarly, silver futures for the same expiry date dropped by 0.83%, quoted at Rs 1,47,278 per kg. These fluctuations reflect global market dynamics and local economic factors, making it essential for investors to stay updated on gold price trends.

Gold and Silver Prices Across Indian Cities

Gold prices vary slightly across major Indian cities due to local taxes, transportation costs, and demand. Below is a detailed breakdown of 22K and 24K gold rates as of October 24, 2025:

| City | 22K Gold (per 10gm) | 24K Gold (per 10gm) |

|---|---|---|

| Delhi | Rs 1,14,790 | Rs 1,25,220 |

| Jaipur | Rs 1,14,790 | Rs 1,25,220 |

| Ahmedabad | Rs 1,14,690 | Rs 1,25,120 |

| Pune | Rs 1,14,690 | Rs 1,22,070 |

| Mumbai | Rs 1,14,640 | Rs 1,25,070 |

| Hyderabad | Rs 1,14,640 | Rs 1,25,070 |

| Chennai | Rs 1,14,640 | Rs 1,25,070 |

| Bengaluru | Rs 1,14,640 | Rs 1,25,070 |

| Kolkata | Rs 1,14,640 | Rs 1,25,070 |

The slight variations in prices across cities reflect local market dynamics, including demand for gold during the festive season and regional taxes. For instance, Delhi and Jaipur report marginally higher rates for both 22K and 24K gold compared to southern cities like Chennai and Bengaluru.

International Gold and Silver Market Trends

Globally, gold prices have shown resilience despite a recent correction. As of 9:20 AM IST, US spot gold surged by 1.65%, trading at $4,117 per ounce. Silver also saw gains, rising by 1.09% to $48.62 per ounce. These international price movements significantly influence Indian markets, as India is one of the largest importers of gold. The interplay between global and domestic factors keeps the market volatile, requiring constant monitoring by investors.

The rise in international gold prices can be attributed to geopolitical uncertainties, inflation concerns, and demand for safe-haven assets. Silver, often considered a secondary precious metal, follows similar trends but is more volatile due to its industrial applications. These global trends directly impact gold prices in India, as import costs and exchange rate fluctuations play a significant role.

Factors Influencing Gold Prices in India

Several factors contribute to the daily fluctuations in gold prices across India:

- International Market Rates: Global gold and silver prices, driven by demand, geopolitical events, and economic policies, directly affect Indian prices.

- Import Duties and Taxes: India imposes significant duties on gold imports, which increase the final retail price for consumers.

- Exchange Rate Fluctuations: Since gold is priced in US dollars globally, changes in the INR-USD exchange rate impact local prices.

- Festive and Wedding Demand: India’s cultural affinity for gold during festivals like Diwali and wedding seasons drives demand and prices.

- Economic Conditions: Inflation, interest rates, and economic stability influence investor sentiment toward gold as a safe-haven asset.

These factors create a dynamic pricing environment, making it essential for buyers and investors to stay informed. For instance, the recent post-Diwali correction reflects a natural market adjustment after heightened festive demand.

Cultural and Financial Significance of Gold in India

In India, gold holds a unique position as both a cultural and financial asset. It is deeply embedded in traditions, especially during weddings and festivals like Diwali, where gifting gold is considered auspicious. Beyond its cultural significance, gold is a preferred investment option due to its ability to hedge against inflation and economic uncertainties. The demand for 22K and 24K gold spikes during festive seasons, contributing to price volatility.

Investors often view gold as a safe-haven asset during turbulent economic times. Its value tends to rise when other investment options, such as stocks or real estate, face uncertainty. This makes gold a critical component of diversified investment portfolios in India. Additionally, gold’s liquidity allows investors to buy or sell it easily, further enhancing its appeal.

Tips for Gold Buyers and Investors

For those looking to purchase or invest in gold, the following tips can help navigate the market:

- Monitor daily price updates from reliable sources like the MCX or local jewelers.

- Compare prices across cities to find the best deals, as rates vary slightly.

- Consider buying during price dips, such as the current post-Diwali correction.

- Verify the purity of gold (22K or 24K) to ensure value for money.

- Stay informed about global market trends and exchange rate movements.

By staying proactive and informed, buyers can make well-timed decisions, whether purchasing gold for personal use or investment purposes. The current market dip presents a potential opportunity for investors to enter the market before prices rebound.

Outlook for Gold and Silver Prices

The outlook for gold and silver prices remains dynamic, with global and domestic factors playing a significant role. The recent uptick in international gold prices suggests continued demand for safe-haven assets. However, the correction in India post-Diwali indicates a temporary softening of demand, which could stabilize in the coming weeks. Silver, with its dual role as a precious and industrial metal, may see sharper fluctuations due to its sensitivity to economic conditions.

Investors should keep an eye on upcoming economic data releases, such as inflation reports and US Federal Reserve policies, which could influence global gold prices. In India, the ongoing monsoon season and its economic impacts may also affect consumer sentiment and gold demand. Staying updated with daily price trends and market analyses is crucial for making informed decisions in this volatile market.

Comment / Reply From

No comments yet. Be the first to comment!