Trump's Tariffs on China: US & India Market Impact

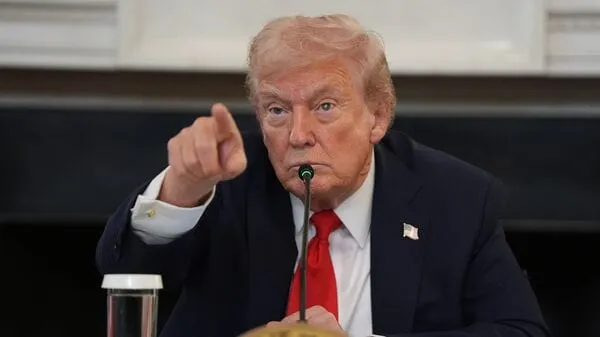

Trump's 100% Tariffs on China: Effects on US and Indian Stock Markets

US President Donald Trump's decision to impose an additional 100% tariff on Chinese imports, on top of the existing 30% duties, effective from November 1, 2025, or earlier, marks a significant escalation in trade tensions. This move, coupled with export controls on critical US software to China, responds to Beijing's restrictions on rare earth elements. Trump tariffs on China could reshape global trade dynamics, raising concerns about inflation, growth slowdowns, and volatility in stock markets worldwide, including the US and India. As the world's two largest economies clash, investors are bracing for ripples that might dampen risk assets and complicate monetary policies.

The announcement has already stirred uncertainty, with experts warning of potential stagflation risks in the US and broader global economic headwinds. For India, while direct hits from the 50% tariffs on its exports persist, indirect benefits like falling crude oil prices could bolster the rupee and attract foreign inflows. Amid ongoing India-US trade talks, which saw positive notes from Prime Minister Narendra Modi's recent call with Trump, the market's resilience hinges on negotiation outcomes and oil trends. This guide unpacks the trump china trade war implications for equities, drawing on strategist insights for a balanced view.

US Stock Market Under Pressure: Inflation and Growth Challenges

The imposition of trump tariffs on china is poised to exacerbate inflationary pressures in the US, complicating the Federal Reserve's efforts to navigate a softening labor market and persistent price rises. Higher costs for imported goods, particularly electronics and machinery reliant on Chinese supply chains, could push consumer prices up by 1-2%, according to preliminary economic models. This environment risks tipping the economy toward stagflation—a toxic mix of stagnant growth and rising inflation—that historically erodes investor confidence and triggers sell-offs in equities.

Wall Street indices like the S&P 500 and Nasdaq, already trading at elevated valuations, may face downward corrections as trade war fears resurface. Sectors exposed to China, such as technology and manufacturing, stand to suffer most, with companies like Apple and Boeing potentially facing margin squeezes from disrupted supply lines. The software export curbs add another layer, limiting US firms' revenue from China and prompting retaliatory measures that could further dent corporate earnings.

- Technology stocks: Heavily reliant on Chinese components, vulnerable to cost hikes.

- Consumer discretionary: Higher prices may curb spending, hitting retail giants.

- Financials: Elevated volatility could widen credit spreads and slow lending.

Longer-term, if unresolved, these tariffs might shave 0.5% off US GDP growth in 2026, per think-tank estimates, amplifying recession odds and pressuring the Fed to delay rate cuts. Investors should monitor upcoming earnings seasons for tariff-related guidance, as multinationals reroute supply chains to alternatives like Vietnam or Mexico.

Expert Views: Global Trade War Risks and Stagflation Warnings

Market veterans like VK Vijayakumar, Chief Investment Strategist at Geojit Investments, view the 100% tariff hike as a short-term shock with potential for prolonged global repercussions. He cautions that while Trump has backed down before, this escalation—echoing the 2018 trade war initiation—could reignite hostilities, especially given China's strong negotiating leverage through rare earth dominance. The result: a drag on worldwide trade volumes and growth, hitting export-dependent economies hardest.

Vijayakumar highlights rising stagflation probabilities in the US, where tariffs fuel inflation without boosting domestic output sufficiently. For equities, high valuations leave little buffer against sentiment-driven dips. Similarly, G. Chokkalingam of Equinomics Research warns of weakened global markets, with the US facing dual blows of inflation and subdued GDP, while China grapples with export slumps. Their interconnectedness means spillover effects to emerging markets, though swift resolutions could limit damage.

- Trade volume decline: Potential 5-10% drop in US-China bilateral flows.

- Growth slowdown: IMF projections may revise downward for 2026.

- Asset class shift: Flight to safe havens like bonds and gold.

Both experts stress monitoring diplomatic channels, as de-escalation could spark relief rallies. In the interim, diversified portfolios with hedges against volatility remain prudent amid this trump china trade war uncertainty.

Also Read: Tata Elxsi Shares Dip 3% on Q2 Slump

Indian Stock Market Resilience: Opportunities Amid Global Turbulence

Despite the 50% tariffs on Indian goods to the US, the indian stock market may sidestep severe fallout from trump tariffs on china, thanks to strategic partnerships and indirect positives. Recent Modi-Trump discussions signal progress in trade pacts, potentially easing duties on pharmaceuticals and textiles—key export sectors. With Nifty 50 up nearly 3% in early October 2025, momentum from earnings rebounds could propel indices toward record highs if negotiations yield deals.

Chokkalingam suggests India could tactically evade global weakness, as US aggression targets China primarily, avoiding bolstering a China-India-Russia axis. Moreover, crashing crude prices—down 24% from peaks post-announcement—offer tailwinds: lower inflation eases RBI pressures, strengthens the rupee, conserves forex, and boosts margins in oil-dependent industries like aviation and chemicals.

- Rupee appreciation: Potential 2-3% gain against USD on sustained oil dip.

- FPI inflows: Shift from China could channel $5-10B into Indian equities.

- Sector boosts: Energy and auto firms gain from cheaper inputs.

Vijayakumar echoes that while sentiment may waver initially, India's domestic drivers—like robust monsoons and capex cycles—provide insulation. If oil trends lower, it sets the stage for rate cuts, fueling mid-cap rallies. Investors eyeing long-term should focus on tariff-exempt sectors like IT services, which benefit from US-China decoupling.

Broader Implications: Global Growth and Investor Strategies

The trump china trade war extends beyond bilaterals, threatening supply chain realignments that favor India as a manufacturing hub. With China's export setbacks, Indian firms in electronics and renewables could capture market share, enhancing Nifty's appeal. However, prolonged tensions might elevate commodity volatility, indirectly pressuring import-heavy sectors like metals.

For US investors, diversification into non-China exposed assets is key, while Indians might leverage falling oil for consumption plays. Both markets could see volatility spikes, but historical trade spats suggest 3-6 month resolutions, paving way for rebounds. Tracking G20 summits and WTO filings will be crucial for sentiment gauges.

- Supply chain shifts: India gains in semiconductors and EVs.

- Commodity trends: Softer metals if Chinese demand wanes.

- Policy responses: RBI forex interventions to stabilize rupee.

Ultimately, while short-term dips loom, strategic positioning amid this tariff escalation could yield opportunities, underscoring the need for agile portfolios in an interconnected world.

Navigating Uncertainty: Key Takeaways for Investors

In summary, trump tariffs on china amplify us stock market risks through inflation and growth drags, yet india stock market dynamics offer buffers via oil savings and trade progress. Experts urge caution on overvalued assets, favoring quality stocks resilient to trade shocks. As negotiations unfold, balanced exposure across geographies will mitigate downsides while capturing upsides from realignments.

Stay informed on policy updates, as swift de-escalation could reverse sentiment swiftly, rewarding patient investors in this fluid landscape.

Comment / Reply From

No comments yet. Be the first to comment!