Modi Govt’s GST Cut: Economic and Political Masterstroke

Why Modi Government’s GST Cut Is a Win for Economics and Politics

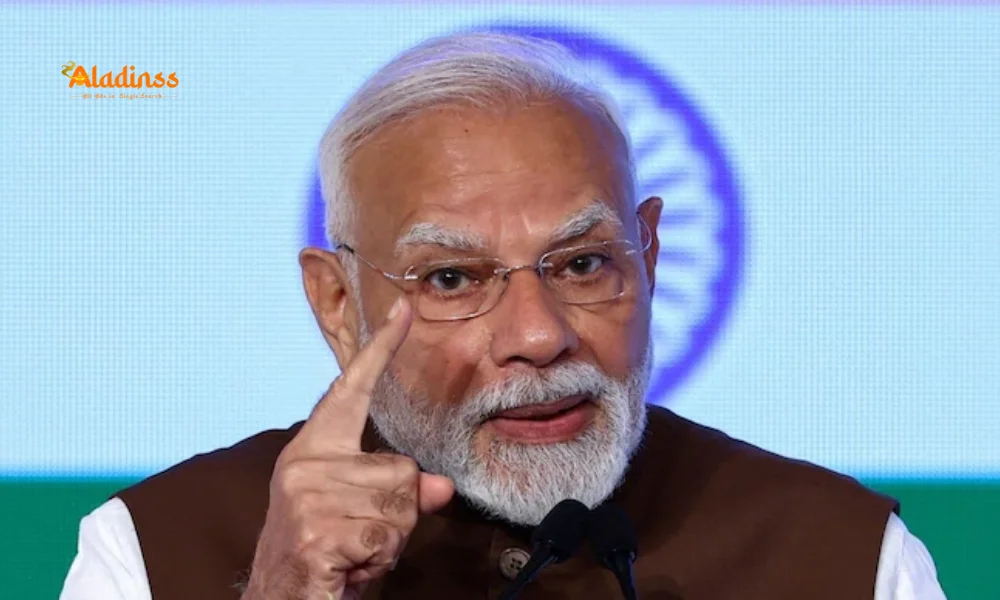

In a strategic move, the Narendra Modi government has announced a significant Goods and Services Tax (GST) cut effective from September 22, 2025, aimed at boosting consumer spending and providing economic relief ahead of the festive season. Described as both good economics and good politics, this decision is expected to stimulate consumption, enhance public purchasing power, and strengthen the Bharatiya Janata Party’s (BJP) position in upcoming state elections in Bihar, West Bengal, Assam, Kerala, and Tamil Nadu. The GST cut, combined with earlier income tax relief, is being positioned as a major gift to the common man, aligning with the government’s broader economic and political objectives.

Economic Rationale Behind the GST Cut

The GST cut, effective from September 22, 2025, is designed to spur consumption, a critical driver of India’s economy, which accounts for over 60% of the nation’s GDP. By reducing tax rates on a wide range of goods and services, the government aims to put more money into the hands of consumers, thereby increasing their purchasing power. Government sources anticipate record consumer spending during the festive season, particularly during Navratri (starting September 22) and Diwali (October 20), as lower prices encourage purchases of essentials and aspirational goods.

The GST reform simplifies the tax structure by reducing the existing four slabs (5%, 12%, 18%, and 28%) to two main slabs (5% and 18%), with a new 40% slab for luxury and sin goods. Nearly every item vital to the common man, such as daily essentials, has seen a massive reduction to either 5% or 0% GST. Notable exemptions include medical and life insurance, as well as 33 life-saving drugs and most medicines, which now attract lower or nil GST rates. These changes are expected to reduce the cost of living, particularly for low- and middle-income households, and stimulate demand across sectors like consumer goods, healthcare, and agriculture.

Boosting Economic Growth

The economic impact of the GST cut extends beyond consumer spending. By lowering tax rates on essential goods, the government aims to address inflationary pressures, which have been a concern amid global economic uncertainties. Experts suggest that the reduction in GST rates could lead to a 50-60 basis point drop in Consumer Price Index (CPI) inflation over the next year, particularly due to lower taxes on food and beverage items. This disinflationary effect is expected to create room for the Reserve Bank of India (RBI) to consider interest rate cuts, further stimulating economic activity.

Additionally, the simplified tax structure reduces compliance burdens for businesses, particularly Micro, Small, and Medium Enterprises (MSMEs), which form the backbone of India’s economy. Pre-filled GST returns, faster refunds, and streamlined registration processes are part of the reform package, enhancing the ease of doing business. This is expected to boost manufacturing competitiveness, support the Atmanirbhar Bharat (self-reliant India) initiative, and expand the tax base by encouraging formalization of the unorganized sector.

Political Strategy and Electoral Gains

Beyond its economic merits, the GST cut is a calculated political move by the Modi government. With key state elections looming in Bihar, West Bengal, Assam, Kerala, and Tamil Nadu, the BJP is leveraging the tax reductions as a central plank of its election campaign. The party aims to highlight its commitment to improving the lives of the common man by increasing disposable income and reducing the cost of essential goods. The timing of the GST cut, coinciding with Navratri, ensures that consumers can benefit from lower prices during the festive season, amplifying the political goodwill generated by the reform.

Finance Minister Nirmala Sitharaman emphasized the political narrative during a press conference on September 3, 2025, contrasting the Modi government’s success in implementing GST reforms with the United Progressive Alliance’s (UPA) failure to do so. She noted that states lacked trust in the UPA government, which hindered GST implementation during its tenure. By framing the Congress party’s potential opposition to the GST cuts as anti-public, the BJP aims to position itself as the champion of the common man, potentially swaying voters in the upcoming elections.

Strategic Timing of the GST Cut

The Modi government’s decision to fast-track the GST cut implementation was driven by the need to maximize consumer spending during the festive season. Prime Minister Narendra Modi first announced the GST rationalization exercise as a “Diwali gift” during his Independence Day speech on August 15, 2025. Recognizing that consumers might delay purchases in anticipation of price reductions, the government chose to implement the cuts on September 22, the first day of Navratri, ensuring that the benefits are felt well before Diwali on October 20.

This strategic timing is expected to prevent a dip in festive season sales, as lower prices on essentials like food items, household goods, and healthcare products encourage immediate spending. The government’s proactive approach reflects its understanding of consumer behavior and its commitment to sustaining economic momentum during a critical period.

Key Beneficiaries of the GST Cut

The GST cut targets a broad spectrum of beneficiaries, from low-income households to small businesses. Essential goods such as packaged foods, toiletries, and agricultural equipment have seen tax rates reduced to 5% or 0%, making them more affordable for the common man. The exemption of GST on medical and life insurance is a significant relief for families, particularly those dealing with healthcare expenses. Similarly, the reduction in GST on life-saving drugs and most medicines addresses a critical need, ensuring access to affordable healthcare.

For businesses, the simplified tax structure and reduced rates on inputs lower production costs, particularly for MSMEs in sectors like textiles and manufacturing. The automotive sector, including small cars and two-wheelers, benefits from a reduction in GST from 28% to 18%, which is expected to boost sales for companies like Maruti Suzuki and Hero MotoCorp. The cement industry, a key component of infrastructure development, also stands to gain from lower tax rates, potentially reducing construction costs and supporting real estate growth.

Fiscal Implications and Revenue Management

While the GST cut is expected to stimulate economic activity, it comes with potential revenue challenges. Estimates suggest a revenue loss of Rs. 50,000 crore to Rs. 93,000 crore for the government due to the tax reductions. To offset this, a new 40% GST slab has been introduced for luxury and sin goods, such as high-end cars, tobacco, and carbonated drinks, which is projected to generate Rs. 45,000 crore in revenue. The government expects that increased consumption and economic growth will lead to higher tax collections in the long term, mitigating the initial revenue dip.

The Modi government’s strong track record in fiscal consolidation, with a target of reducing the fiscal deficit to 4.4% of GDP in FY26, suggests that it will carefully manage any revenue shortfall. Economists note that the government may trim non-essential spending or adjust capital outlays to stay on track, ensuring that the GST cut does not compromise fiscal discipline.

Political Narrative and Opposition Response

The BJP is capitalizing on the GST cut to strengthen its political narrative ahead of the state elections. By framing the tax reductions as a direct benefit to the common man, the party aims to counter opposition criticism and appeal to voters in key states. Finance Minister Sitharaman’s remarks challenging the Congress to clarify its stance on the GST cuts are intended to put the opposition on the defensive, portraying any criticism as anti-consumer.

The Congress party, which has previously criticized the GST as the “Gabbar Singh Tax” for its impact on the masses, faces a dilemma. Opposing the tax cuts could alienate voters, while supporting them might weaken its narrative against the BJP. The Modi government’s ability to implement GST reforms, unlike the UPA’s failure to do so, adds to the BJP’s political advantage, reinforcing its image as a reform-driven administration.

Comment / Reply From

No comments yet. Be the first to comment!